At the Allinial Global EMEIA Regional Conference in June, Pamela Cone, ISSP-SA, of Amity Advisory shared insights on the accountant’s role in enabling better Environmental, Social, and Governance (ESG) reporting. Even for someone like me who is pretty informed about ESG, I found myself thinking deeply about her call to action and how we as accountants can have a broader impact on society through our clients.

A Heightened Need for ESG

Pamela’s presentation traced the origins and history of ESG, highlighting how it has evolved to take a place of greater prominence today. As early as 2010, groups of CEOs had introduced the term “sustainable value creation,” which was intended to look beyond quarterly earnings statements and take a longer-term view of the impact businesses have on society. Then, in 2019 the Business Roundtable, a group of 200 CEOs in the United States, issued a statement that adjusted the “purpose of a corporation” to include business goals such as investing in employees, delivering value to customers, dealing ethically with supplies, and supporting outside communities.

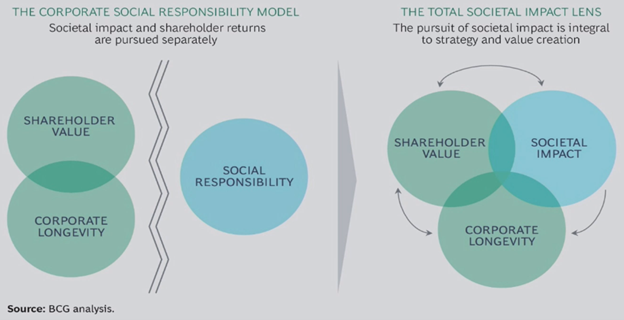

Pamela also shared a diagram from Boston Consulting Group (see Figure 1) that illustrates how ESG requires us to integrate societal impact with other business aspects (right side) rather than addressing it separately (left side), as has been the case with corporate social responsibility (CSR).

“Historically CSR embodied the values of a company. ESG has long been an investment term focused on the value of a company … what the pandemic has taught us is that those two things are inextricable: the values and value of a company are inextricably intertwined,” she continued.

Accountants Have Broad Societal Impact

Pamela equated ESG with the Triple Bottom Line that has been discussed in the past as people, planet, and profit. She also provided some examples of ESG, including:

- Ethics, compliance, and governance

- Diversity, equity, and inclusion

- Environmental issues, carbon footprint, and climate change

- Pro bono work

- Community involvement and volunteering

- Charitable giving and philanthropy

- The work you do with clients

She emphasized that accountants, as part of professional services firms, must include the work they do with clients as part of their ESG footprint. If they don’t, it would be like a manufacturing company neglecting to include resource extraction, the energy used in production, and the disposal of waste in their ESG statement. As Pamela pointed out, accounting firms have both an obligation and an opportunity to make a societal impact through their client work.

Personal note from Donny:

Increased Public Statements and the Need for Accountability

Citing various heated events during the pandemic, from the George Floyd trial to the ongoing Russian invasion of Ukraine, Pamela explained that expectations for executives to take a stand on societal matters have increased to the point where leaders risk being chastised by employees if they don’t take a position.

Public statements are usually considered more of a public relations exercise, but they can also draw scrutiny when a company’s actions are not in accord with its statements. For example, Pamela cited instances when law firms had stated a commitment to the environment but then served oil and gas companies on matters with adverse environmental impacts.

A group of students from Yale Law School called Law Students for Climate Change is helping to hold law firms accountable by looking at the types of cases law firms are taking on and how those cases impact the environment. Their group’s work has sparked a change in many law firms’ case acceptance policies, where they may continue to serve oil and gas companies, but not in cases adversely impact the environment.

The need for accountability is not limited to the area of law, though. Pamela shared a Principles of Responsible Investing article from September 2021 that said:

“More than 70% of listed companies that represent some of the world’s largest carbon polluters, alongside most of their external auditors, are not fully accounting for climate-related risks in financial statements. This is despite significant financial risks faced from the climate crisis and net-zero pledges made by many.”

Pamela went on to remind us that the public relies on auditors to ensure the integrity of information published by companies, so we need to ensure that our clients are being held accountable and presenting an accurate picture of their ESG efforts.

Accountants Play a Critical Role in ESG

As an accountant, Pamela’s statements really hit me hard—in a good way. I knew that we needed to be involved in ESG, but not to the level of societal impact that she described. I knew that we as accountants have a huge impact on our clients’ ability to be successful, whether through business planning, risk management, enabling access to capital, or financial planning. But I hadn’t thought about it as part of our contribution to society—or our impact on society. That was a revelation to me, and it steeled my resolve to figure out how we as accountants can measure our impact on society.

In the remainder of her conference presentation Pamela covered several examples of ESG frameworks and how firms can use them to measure their own ESG impacts (and eventually reporting), as well as how they can assist clients in implementing them. Allinial Global members can access a recording of her full presentation via Vario, and I highly recommend that you check it out.